Recent data indicated that approximately 40% of mum-and-dad businesses in the SME market are not making a profit. Coupled with the ATO’s increasingly aggressive debt collection efforts targeting SMEs, this spells trouble. Desperate to keep their companies afloat, many business owners are turning to financing to pay off tax debts — a strategy that can backfire if not carefully managed.

Initially, the superannuation, GST and PAYG are unsecured business debts. Furthermore, the ATO has no priority over any other unsecured creditors, and it doesn’t have personal guarantees unlike many creditors or suppliers. However, the ATO can use the law to give itself a de facto personal guarantee making the Director personally liable for these debts and thereafter giving them the ability to take direct action against the Director.

Most small business owners see their business like it’s another child, and in difficult times, may feel compelled to take risky steps to protect it. As advisors, it’s important to counsel against these risky measures and instead guide clients towards viable options that protect both their business and personal assets.

We have observed that directors of struggling companies often do two things:

– They stop paying themselves, relying on personal savings to keep the business going

– They inject additional funds into the business, often from their superannuation or by borrowing from banks and other lenders

In many cases, directors will encumber any available assets in a determined attempt to keep the business afloat.

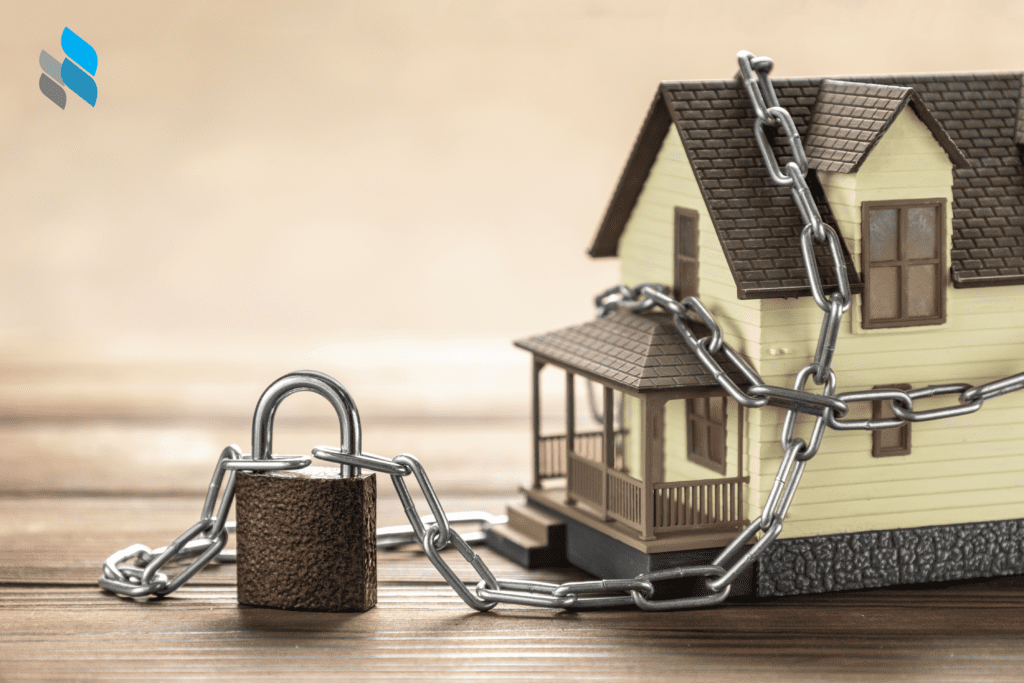

If a director borrows money to pay out the tax debt, most lenders would require security in the form of a mortgage. By using their home as security to pay the ATO, the director is effectively turning an unsecured debt into a secured debt. Let me repeat that – they are turning an unsecured debt into a debt that is secured – and often tied to the family home.

From an advisor’s point of view, this is a risky and dangerous strategy, especially if the business is already struggling, as it merely kicks the can down a road that may end in a dead-end.

—

To illustrate, we recently had a client who owed the ATO $350,000. They had a Director Penalty Notice (DPN) for $120,000, which they let expire, confident that business would improve, and they’d be able to repay the debt. Against our recommendation to restructure, they instead borrowed the full $350,000 against their family home to pay out the company debt.

Had they proceeded with our earlier restructuring recommendation, they would have only needed to address the $120,000 debt. Approximately 12 months later, they returned to us. While they had paid the ATO debt, the business hadn’t improved, and new debts were beginning to accumulate. Realising their business would not recover, all we could do was assisted them in a controlled exit of the business.

Unfortunately, we couldn’t alter the mortgage, which had increased by $350,000 and now required refinancing, adding further fees and interest.

As advisors, it’s important to remain objective when clients are determined to pay off debt and to help them avoid actions that could worsen their situation for decades to come.

If you have clients considering borrowing to pay tax debt, we encourage you to refer them to de Jonge Read. We can review their situation, as there may be more viable options — such as a restructure, voluntary administration, or DOCA — that better protect their business without risking personal assets unnecessarily. Without strategic guidance, financing tax debt can put clients’ personal assets, including their family home, at serious risk.

Should you have clients or associates that you know are struggling with financial issues or need assistance in reviewing their business affairs in preparation for what’s around the corner, our team of Strategists would be pleased to discuss options that are available on how to best design and implement insolvency strategies. Contact us now on p. 1300 765 080 | ua.mo1743676628c.arj1743676628d@ofn1743676628i1743676628

Did you know?

Phoenixing is another name of business restructure. Read more about business restructures and when this can be an option for you.