What is Safe Harbour?

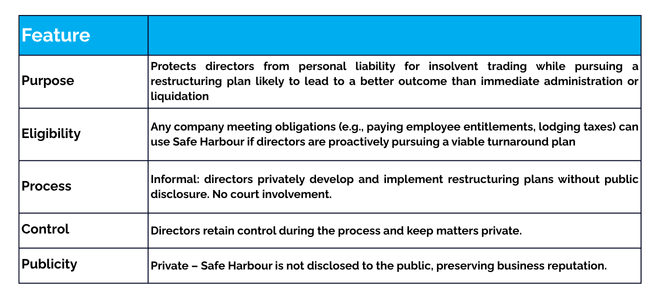

Introduced in 2017, the Safe Harbour provisions under section 588GA of the Corporations Act 2001 were designed to protect directors from personal liability for insolvent trading when they are actively pursuing a course of action reasonably likely to lead to a better outcome for the company than immediate administration or liquidation. This means that Safe Harbour refers to specific laws that provide a ‘carve-out’ from the usual insolvent trading rules, giving directors a legal pathway to manage financial distress.

To qualify for Safe Harbour protection, directors must ensure the company is meeting its obligations to pay employee entitlements and comply with tax reporting requirements, which are crucial elements of Safe Harbour laws. These rules ensure that directors demonstrate good governance and responsibility while navigating financial difficulties.

Key Features and Recent Developments

In December 2024, ASIC released an updated version of Regulatory Guide 217 (RG 217), providing detailed guidance on how directors can establish Safe Harbour protection. The updated guidance emphasises the importance of directors:

- Actively monitoring the company’s solvency;

- Investigating financial difficulties;

- Obtaining advice from appropriately qualified professionals; and

- Acting in a timely manner.

ASIC’s guidance also clarifies that Safe Harbour is a ‘carve-out’ from insolvent trading liability, not merely a defence, underscoring its distinction from traditional insolvent trading rules.

Overview of Safe Harbour

When Should You and Your Clients Consider Safe Harbour?

While Safe Harbour remains a valuable tool for directors, it’s essential to understand when it’s most appropriate. Safe Harbour is best considered when:

- A company faces financial distress but retains a reasonable prospect of recovery through restructuring.

- Directors are proactive in managing challenges and taking professional advice.

- Employee entitlements and tax obligations are up to date.

However, precise, up-to-date statistics on the utilisation of Safe Harbour in Australia are limited. This is primarily because Safe Harbour is an informal, confidential process that doesn’t require public disclosure or registration, making comprehensive data collection challenging. Nevertheless, recent insights indicate that while Safe Harbour remains a valuable tool for directors, its adoption is more prevalent among larger companies. In contrast, many SMEs face barriers such as limited awareness of Safe Harbour and the cost of obtaining professional advice, which can hinder its utilisation.

Considerations for You and Your Clients

Given the evolving landscape, it’s crucial for advisors to:

- Assess the Company’s Eligibility: Determine whether the company meets the criteria for Safe Harbour, considering factors such as size, financial position, and compliance history.

- Seek Professional Advice Early: Engaging with qualified advisors promptly can provide clarity on the most appropriate course of action and increase the likelihood of a successful turnaround.

- Understand the Implications: Each strategy carries different implications for control, disclosure, and creditor negotiations. Understanding these nuances is essential for informed decision-making.

—

Safe Harbour remains a vital tool for directors aiming to navigate financial distress without immediate recourse to formal insolvency. Its private nature and flexibility can be advantageous for businesses with a reasonable chance of recovery and a desire to maintain discretion.

At de Jonge Read, we understand the complexity of Safe Harbour, and we’ve guided numerous through the process. Our expert team can help advisors identify the best approach for their clients – whether a Safe Harbour strategy or any other tailored solutions are suited to achieve the best possible outcomes.

If you have clients facing financial challenges, we encourage you to reach out for a confidential discussion. Let’s explore how we can work together to safeguard their future, contact our team today for expert advice.

Should you have clients or associates that you know are struggling with financial issues or need assistance in reviewing their business affairs in preparation for what’s around the corner, our team of Strategists would be pleased to discuss options that are available on how to best design and implement insolvency strategies.

Contact us now on p. 1300 765 080 | ua.mo1760219732c.arj1760219732d@ofn1760219732i1760219732

View All Blogs