All client names used in this article have been changed to protect privacy.

Michael’s wife previously operated a small retail outlet as a sole trader. Unfortunately, the business accumulated significant debts and ultimately ceased trading. Believing she had no other viable option, she entered personal bankruptcy.

Soon after the bankruptcy, the trustee issued a letter demanding payment of $125,000 to acquire the bankrupt estate’s equity in the home. Michael, who was not bankrupt himself, faced the very real prospect of losing the family home, as he had no means of paying the amount sought.

At this point, Michael’s accountant referred the matter to de Jonge Read, seeking clarity around the trustee’s claim and whether anything could be done to protect the property.

What de Jonge Read Uncovered Upon Review

-

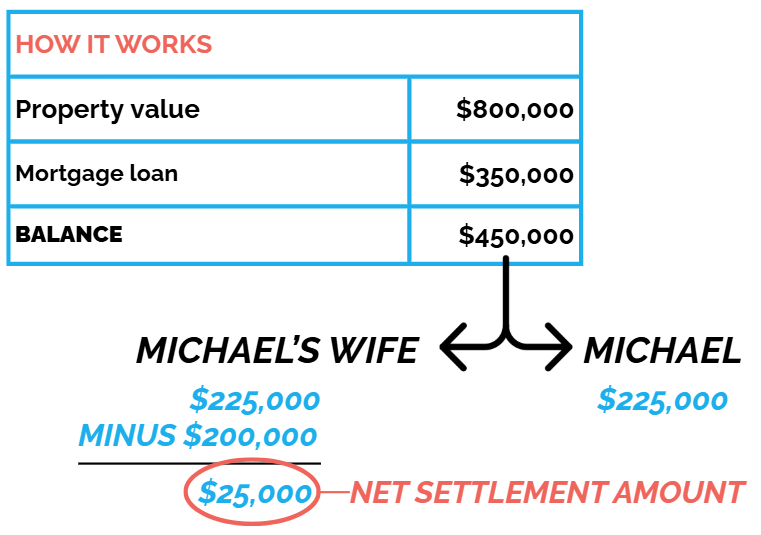

Joint ownership of the family home, estimated at $800,000

-

Mortgage balance was approximately $350,000.

- Two business debts (a $25,000 overdraft and a $175,000 business loan) – secured against the property. Total of $200,000.

-

Business borrowings were solely for wife’s retail business

-

Michael listed as guarantor but with no business involvement

-

Michael had no capacity to refinance to meet the trustee’s demand

Based on the trustee’s assessment, there was approximately $250,000 in equity available in the property. As the property was jointly owned, the trustee was seeking a 50% share of that equity, resulting in a demand for $125,000 on Michael to acquire the bankrupt estate’s interest.

Our team conducted a full review of the secured debts, property ownership, and equity position. It was clear that the $200,000 in borrowings were used exclusively for the operation of the wife’s retail business and had not benefited Michael.

This allowed us to raise the equitable principle of Equity of Exoneration which holds that a co-owner’s share in a property should not be reduced by debts they did not benefit from, even when those debts are secured over the jointly owned asset.

This principle must be carefully applied and properly supported by relevant evidence. Through detailed investigation and preparation, we were able to present a strong, well-documented position to the trustee. The evidence showed that the $200,000 in secured business borrowings had provided no benefit to Michael, and the trustee ultimately accepted that the Equity of Exoneration applied in this case.

An independent property valuation was also obtained to support a more accurate equity calculation. We then prepared a comprehensive submission to the trustee, clearly outlining the legal and factual basis for a reduced claim.

Results and Outcomes

-

Trustee’s claim reduced from $125,000 to approximately $25,000

-

Michael was able to retain the family home

-

No refinance or forced sale was required

This outcome was achieved after bankruptcy had already been declared.

—

This matter highlights what can be achieved with the right strategy and specialist guidance, even after bankruptcy has been declared. With our involvement, a claim that initially appeared final was substantially reduced, enabling the client to retain the family home without the need to refinance or force a sale.

By identifying the true nature of the secured debts and applying the appropriate legal principles, we were able to challenge the trustee’s position and negotiate a more accurate outcome. Although a demand had already been issued, there was still time to act. With expert guidance and a coordinated approach, the result shifted considerably in the client’s favour.

It is a reminder that even in high-pressure, time-critical post-bankruptcy situations, positive outcomes can still be achieved. These results aren’t achieved by chance. They come from timely engagement and experienced, specialist advice.

If you’re working with a client facing a trustee claim or similar pressures, reach out early to discuss your client’s options.

Should you have clients or associates that you know are struggling with financial issues or need assistance in reviewing their business affairs in preparation for what’s around the corner, our team of Strategists would be pleased to discuss options that are available on how to best design and implement insolvency strategies.

Contact us now on p. 1300 765 080 | ua.mo1759944345c.arj1759944345d@ofn1759944345i1759944345

View All Blogs